Why Choose Akulaku

Judul : Why Choose Akulaku

Link : Why Choose Akulaku

Why Choose Akulaku

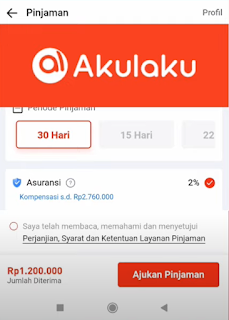

Akulaku Operates A Platform That Allows Borrowers To Apply For Loans Online And To Buy Items On Credit. The Platform Also Allows E-commerce Customers To Buy Items On Credit And Pay Them Back Over Time. The Platforms Allow Borrowers To Apply For Cash Loans Online,

And Other Users Can Get Credit Cards Or Insurance. Akulaku Operates In Several Countries In Southeast Asia, Such As Indonesia, Malaysia, Philippines, Vietnam And Thailand. A Lender May Approve Or Deny A Borrower's Application For A Loan From A Platform That Allows Borrowers To Get A Cash Loan By Connecting Them With One Or More Lenders.

The Lender Will Process The Loan By Sending The Borrower An Email Stating The Amount He Has Borrowed And How Much Time He Has Left To Repay The Money He Borrowed. Application Forms For A Loan Typically Include Information Such As Income,

Employment, And Credit History. When The Lender Approves The Application, It Will Tell Borrowers When To Expect To Receive The Money. It Is Necessary For Borrowers To Provide Information About Their Income, Their Employment And Their Credit History. The Lenders Will Review The Information To Determine If The Borrower Is Eligible To Receive A Loan. Lenders Will Look At Borrower's Income, Employment And Credit History In Order To Understand If The Borrowers Will Be Able To Repay The Loan.

They Will Decide Whether Or Not To Grant The Loan. Platforms For Facilitating Cash Loans Are Online Services That Match Borrowers With Lenders To Help Them Find A Lender Who Is Willing To Provide A Loan. These Companies Require Borrowers To Fill Out An Application With Information About Their Income, Their Employment And Their Credit History. Loans Are Generally Arranged On A Platform That Matches Borrowers With Lenders Who Are Willing To Give Them A Cash Loan. Platforms Can Help Borrowers Obtain Loans By Matching Them With Lenders Who Are Willing To Provide The Money.

They Can Help Borrowers To Pay Back The Money That They Borrowed. Some Of The Most Popular Platforms For Arranging Cash Loans Are Lending Club, Prosper And Upstart.

cara kredit akulaku tanpa dp cara belanja di akulaku tanpa dp cara kredit akulaku dengan dp dp hp di akulaku cara akulaku dp 0 cara kredit hp di akulaku pakai dp cara ambil hp di akulaku tanpa uang muka cara kredit hp di akulaku tanpa uang muka cara cicilan akulaku tanpa dp cara cicilan di akulaku tanpa dp ngambil hp di akulaku tanpa dp cara agar akulaku tanpa dp cara akulaku tanpa dp cara akulaku tanpa uang muka cara beli akulaku tanpa dp cara kredit hp akulaku tanpa uang muka akulaku ga bisa cicilan cara agar akulaku bisa cicilan kredit akulaku tidak bisa digunakan tidak bisa mengajukan limit kredit akulaku tidak bisa kredit di akulaku akulaku dana cicil tidak bisa cara agar bisa menggunakan dana cicil akulaku dana cicil akulaku tidak bisa dana cicilan akulaku tidak bisa cara agar bisa dana cicil di akulaku cara agar bisa kredit hp di akulaku cara agar bisa cicilan di akulaku kredit akulaku bisa dicairkan cara agar cicilan akulaku bisa 12 bulan cara agar dapat dana cicilan di akulaku lazada bisa pakai akulaku cara dapat dana cicil di akulaku tidak bisa cicilan di akulaku cara agar bisa kredit di akulaku cara agar akulaku bisa kredit 12 bulan cara menaikan limit di akulaku cara menambah limit akulaku cara menaikan limit akulaku dengan cepat cara menaikkan skor kredit akulaku cara menaikan limit akulaku cara menaikan limit kredit akulaku cara menaikan kredit akulaku cara menaikan pinjaman kta akulaku akulaku naik limit kenaikan limit pinjaman akulaku cara menaikan limit kredit di akulaku cara menaikan tenor akulaku cara menaikan pinjaman akulaku cara menaikan limit pinjaman akulaku menaikan limit akulaku cara bayar tagihan di akulaku cara bayar tagihan akulaku tanpa aplikasi cara membayar tagihan akulaku cara mencicil tagihan akulaku cara bayar tagihan akulaku cara bayar indihome lewat akulaku bayar tagihan akulaku lewat shopeepay cara bayar tagihan pinjaman akulaku pembayaran tagihan akulaku cara mengecek tagihan akulaku akulaku tagihan perhitungan bunga akulaku bunga akulaku perhari simulasi pinjaman di akulaku bunga akulaku vs kredivo bunga cicilan di akulaku simulasi bunga akulaku bunga dana cicil akulaku perbandingan bunga akulaku dan kredivo bunga kredit akulaku bunga akulaku perbulan bunga kredivo vs akulaku suku bunga akulaku bunga akulaku bunga akulaku cicilan suku bunga kredit akulaku bunga kredivo dan akulaku simulasi pinjaman akulaku akulaku bunga bunga pinjaman di akulaku bagusan akulaku atau kredivo bunga akulaku vs kredivo kredivo vs akulaku akulaku vs kredivo bunga kredivo vs akulaku lebih bagus kredivo atau akulaku bagusan kredivo atau akulakuDemikianlah Artikel Why Choose Akulaku

Anda sekarang membaca artikel Why Choose Akulaku dengan alamat link https://viraldepok.blogspot.com/2023/01/why-choose-akulaku.html

Post a Comment